Election Information

Anyone who was a registered voter and lived within the Beeville ISD district boundaries was eligible to vote in the election. Early voting took place April 22 – April 30 prior to the May 4th Election Day. THANK YOU to everyone who voted. Unofficial election results are 1,304 FOR and 1,148 AGAINST Beeville Independent School District Proposition A, that unofficial report is linked below.

Bond Summary

| Safety and Security | $1,644,377 |

| New Elementary School | $54,688,326 |

| HMD Gym | $200,000 |

| MJH Physical Education Track | $1,962,628 |

| Auditorium Repairs | $3,134,669 | Technology Infrastructure | $750,000 |

| Total Bond | $62,380,000 |

What's Included?

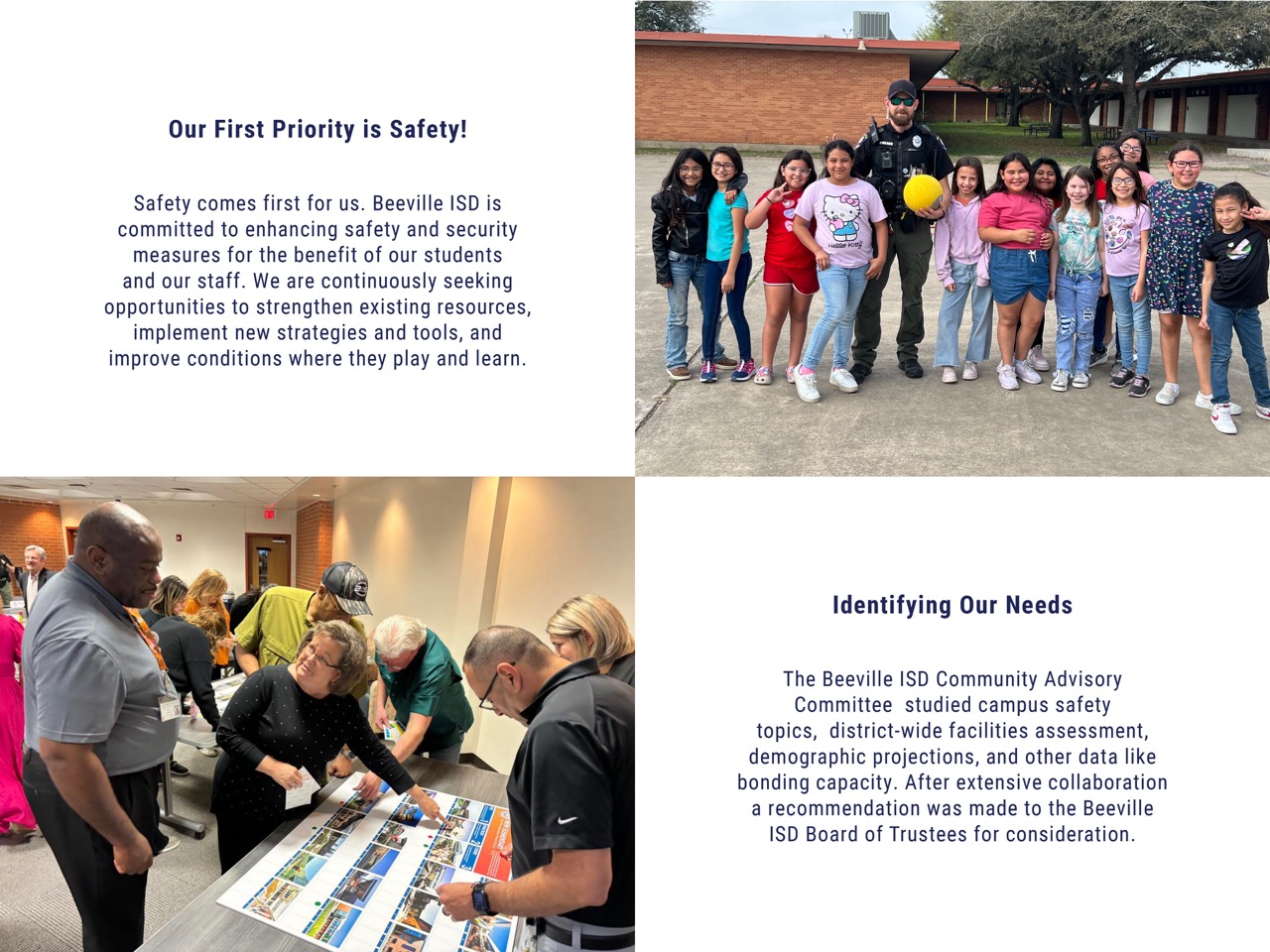

Safety & Security

New Elementary School

Hampton Moreno Dugat Early Childhood Center Gym

Moreno Junior High Physical Education Track

Auditorium Repairs

Technology Infrastructure

About the committee

The Beeville ISD Community Advisory Committee has been hard at work over the past 24 months studying the district’s student enrollment growth, school capacity issues, safety and security, school finances and facility conditions. The group was comprised of school district parents, teachers, administrators, and community members. The work culminated in a long-range plan to ensure that Beeville ISD has future capacity to accommodate student enrollment growth and to provide classroom space for students currently in overcrowded campuses. One of the primary goals of the bond is to enhance the safety and security of students and teachers throughout the district. The bond is also aimed at renovating aging facilities as part of the district’s long-range preventative maintenance plan.

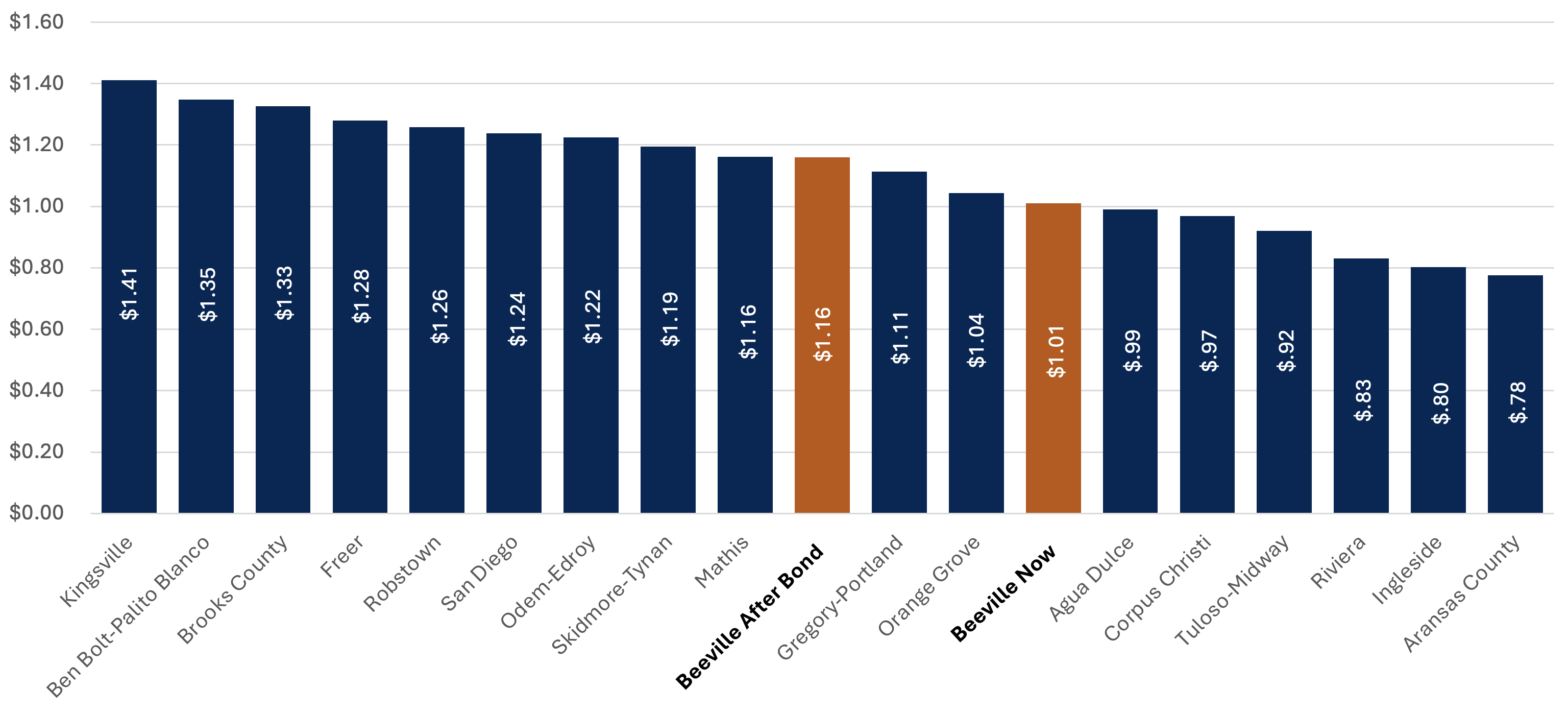

Understanding the Tax Rate

Public school taxes involve two figures which divide the school district’s budget into two “buckets.”

The first is the Maintenance & Operations (M&O) budget, also known as the General Fund. This is used to pay for the day-to-day operations of a district and includes items such as salaries, utilities, food, gas, supplies, etc.

The second is the Interest & Sinking (I&S) budget or Debt Service. This fund is used to repay debt for capital improvements approved by voters through bond elections. This fund is similar to a mortgage or home improvement loan.

Funds from a bond issue can be used for the construction and renovation of facilities, the acquisition of land, and the purchase of capital items, such as equipment, technology, and transportation.

FAQs

Just as homeowners borrow money in the form of a mortgage to finance the purchase of a home, a school district borrows money in the form of bonds to finance construction, renovation and other capital projects. Both are repaid over time, but in order for a school district to sell tax supported bonds, it must go to the voters for approval.

Bond funds can be used to pay for new buildings, additions and renovations to existing buildings, land acquisition, technology, buses, and equipment, among other items. By law, bond funds may not be used to fund daily operating expenses, such as salaries or utilities, which are paid for out of the district’s Maintenance & Operation (M&O) budget.

School districts are required by law to ask voters for permission to issue bonds in order to pay for capital expenditures for projects like building a new school or making renovations to existing facilities. Districts take out a loan and then pay that loan back over an extended period of time, much like a family takes out a mortgage loan for their house.

The Beeville ISD bond was developed by the Community Advisory Committee parents, teachers, campus administrators, and community members. The committee met over the course of nearly two years to study district needs at all grade levels and campuses and discussed the future vision for Beeville ISD students. The group studied campus safety, a district-wide facilities assessment, demographic projections, and other data and made their recommendation to the Beeville ISD Board of Trustees for consideration. Their recommendation was approved unanimously by the Board.

The proposed bond package will focus on three areas: accommodating growth in student enrollment, safety and security improvements, addressing aging facility conditions, and improving instructional program spaces.

TAX EXEMPTIONS are a property owner’s right and can help reduce the tax burden. Want to learn more about the kinds of tax exemptions available, click this link: ATTENTION PROPERTY OWNERS

TAX RATES are set by local units, which can include the county, city, school districts, and special districts, each setting their own tax rates based on their budgetary needs. To see the 2023 tax rates and homestead exemption in Bee County, click this link: 2023 BEE COUNTY TAX RATES & HS EXEMPTION

The total property tax owed by a property owner is calculated by applying the local tax rates to the final taxable value of their property. Tax exemptions help lower the final taxable value of an owner’s property, not the actual assessed value of the property. For example, if a property is assessed at $200,000 and the owner qualifies for a $100,000 homestead exemption, the final taxable value of the property is lowered to $100,000.

- Assessed Value is the market value of the property set annually by the Bee County Appraisal District, not Beeville ISD.

- Total Exemptions is the sum of all applicable exemption amounts the property owner qualifies for (e.g., homestead, senior citizen, disability).

- Tax Rate is the combined local tax rates applied to the property, expressed as a decimal.

The tax impact will be approximately $12.50 per month for a $100,000 home and approximately $25 per month on a $200,000 home. The bond will result in no tax increase for voters ages 65 and older that have filed their senior citizen homestead exemption.

A copy of the exemptions provided by the Bee County Appraisal District is located in response to the above question. Several exemptions are available to Beeville ISD taxpayers. The exemptions include the Homestead, Disabled Persons, Persons Who Are Over 65 Years of Age – Exemptions and Deferral, Disabled Veterans, Farm and Ranch Owners, and Exemptions for Charitable, Religious, and other Total Exemptions. All exemptions are processed by the Bee County Appraisal District or the State Comptroller’s Office at 1-800-252-9121 or click the title: TAX INFO

The bond facts are provided on this bond website and at community meetings, as referenced on the Beeville ISD website and social media.

Homeowners 65 years of age and older can freeze their tax rate, as long as they have filed for their senior citizen homestead exemption. This bond will result in no increase to the tax rate.

From school bonds. Likened to a home mortgage, a voter-approved school bond allows a school district to borrow funds. The Board of Trustees authorizes bond elections, and Texas law grants the Board the authority to sell bonds.

Prior to any bond vote, a volunteer citizen committee is usually created to develop a bond package for presentation to the Board of Trustees. The Board approves the bond package – the specific uses of bond monies and the estimated costs for each project included in the bond.

After voter approval, the school district can sell bonds to investors who are repaid their principal plus interest. Payout is limited by law to 40 years. The district sells bonds that mature at different times, so bond expenditures for items with a shorter lifespan are paid off before the purchase becomes obsolete. This also allows the district to capture the lowest interest rates available.

Importantly, bonds do not cost the district anything until they are sold. A district receives a higher rating due to the guarantee by the Texas Permanent School fund, having a strong fund balance, and maintaining a record of financial management excellence. Of course, market conditions will affect the actual interest rates, which may be higher or lower than the original estimates.

As state agencies, school districts rely on M&O funds to pay for the day-to-day education of the district’s children.

Bonds allow districts to spread the cost of expensive projects across time without affecting the district’s normal educational operations. Also, bond funds all stay with the district, and they are not subject to state recapture, fluctuations in revenue due to state mandates, or other negative economic influences.

In short, bonds save and protect taxpayers while allowing for essential, ongoing facility development and other capital expenses to be funded.

Voters approve a specific dollar amount— or the maximum amount the district is allowed to sell without another election. The school district may then sell their bonds as ‘municipal’ bonds when funds are needed for capital projects, usually once or twice a year.

The interest rate paid is based on the district’s bond rating and the interest rates in effect at the time of sale.

Districts benefit if they have a higher bond rating, meaning a lower interest could be charged. Principal and interest on the bonds are repaid over an extended period with funds from the Debt Service tax rate. (Source: TASB).

Thus, there are two parts to any bond process:

1) bond authorization that specifies the amount of bonds the district is authorized by the voters to sell, and

2) bond sales that may occur over a period of time with the date and amount of each sale determined by the Board on an as-needed basis. (TASB).

Note that a district is not obligated to spend all the authorized monies but cannot exceed the authorization.

A school district’s tax rate consists of two parts:

• Maintenance and Operations (M&O) which funds the General Operating Fund, which pays for salaries, supplies, utilities, insurance, equipment, and the other costs of day-to-day operations; and

• Debt Service (Interest & Sinking or I&S) can be used for a variety of special purposes, assuming voter approval. For example, they may finance facility construction and renovation projects, acquire land, or purchase capital equipment, such as technology, and transportation, such as buses.

The industry standard index used for for Tax-Exempt Municipal Bond Issuances is the “Bond Buyer’s General Obligation Index”. The type of debt like BISD uses are “Tax-Exempt Municipal Bonds”. Due to the fact that bond investors do not pay Federal income taxes on tax-exempt municipal bonds, this type of debt attracts lower interest rates.

Topics From The Community

You can vote at the Bee County Election Administration Office or AC Jones High School – Old Gym.

- Early voting starts April 22nd and runs through April 30th.

- Election Day is May 4, 2024. Polls will be open 7 a.m. to 7 p.m.

For more information, visit Bee County Election website or click the title: VOTING LOCATIONS & HOURS

You can vote at these two locations:

- Bee County Election Administration Office

- AC Jones High School – Old Gym

Early voting starts April 22nd and runs through April 30th and Election Day is May 4, 2024.

For more information, visit Bee County Election website or click the title: VOTING LOCATIONS & HOURS

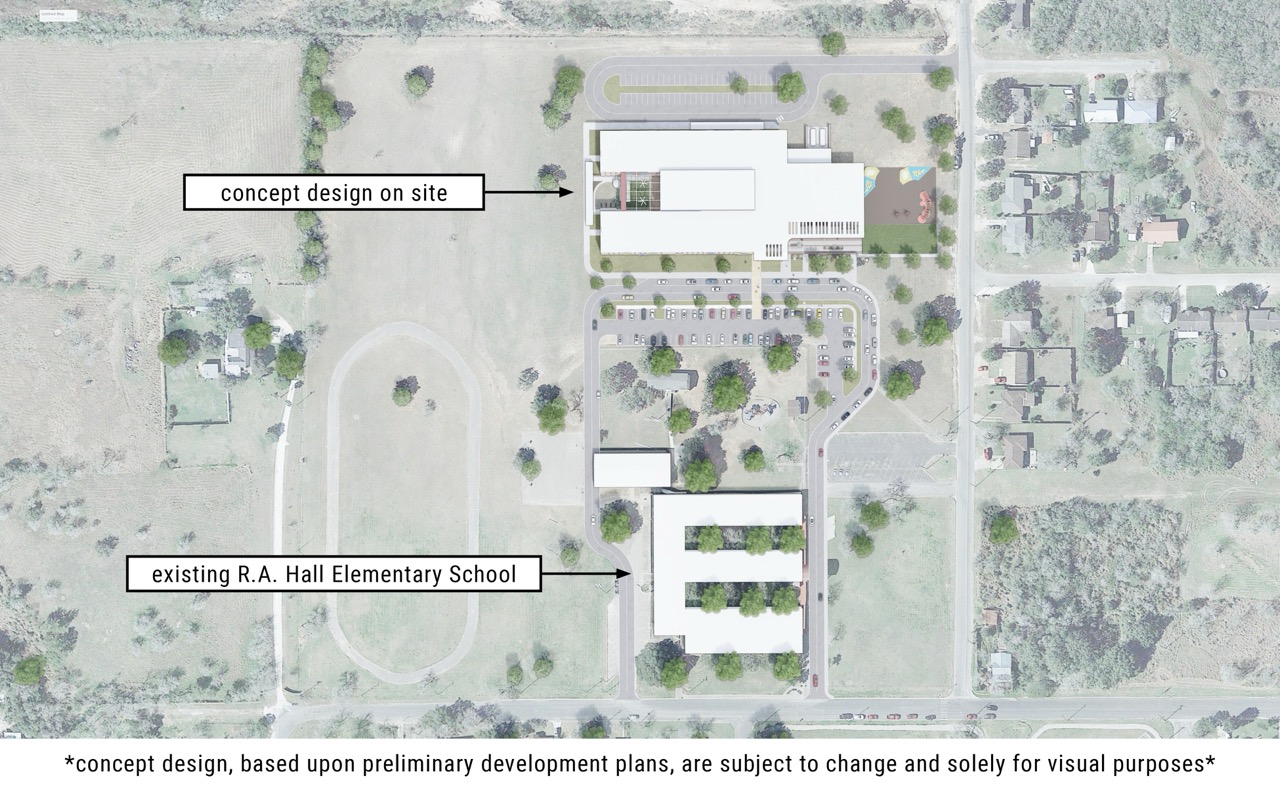

The Principals of RA Hall and FMC have worked very hard to create a culture of a unified elementary working relationship. Both reported their experience has been very positive. The goal is for the success of all elementary students. In the past several years there have been combined staff trainings, team bondings, planning sessions with both campuses, and each campus visits the other for various meetings. In addition, teachers in each grade level reach out to one another on best teaching practices, instructional coaches work together from both campuses on curriculum initiatives, and all levels of administration work together seamlessly.

If the bond is approved, a professional traffic impact analysis will be conducted as part of the design work. The analysis will include:

- Tests.

- Study of the length and configuration of new drives.

- Other necessary steps to meet traffic flow standards and avoid congestion.

The preliminary model of the new elementary school is available for review at community bond meetings. The school will feature designated areas for buses, walkers, students with special needs, and students who are dropped off and picked up.

Our top priority is the safety and security of our students, parents, and community. If the bond passes, a traffic analysis will be conducted to ensure a seamless transition.

If the bond passes, Beeville ISD stakeholders, parents, students, staff, and the community, will have input before the school is approved by School Trustees.

Access control for classrooms ensures that anyone who enters the classroom has passed a security check and is approved to enter with a school district badge. The classroom door remains locked if someone does not have a badge to allow them in or doesn’t have the security access to enter the room.

There are no known flooding problems in the auditorium at AC Jones. There have been previous reports of roof leaks in the auditorium. A roof upgrade project was approved by the Board of Trustees in 2024 and is currently underway to update the roof at AC Jones High School.

The bond election is for $62,380,000. This amount will not increase due to inflation or any other economic factors. The I&S tax rate is projected to decrease every year as bond payments are made and bond debt is lower.

Jobs will not be lost and by combining the two elementary schools we see an opportunity to add dedicated educational services per grade level. We are always interested in talent for our students and positions are posted as the need arises.

If the bond passes, construction can take between 18-24 months. The new school could be open as early as August 2026.

The district has $10,995,625 in Principal and Interest on our bond debt as of 4/3/24. However, the Board of Trustees approved to pay off the Series 2015A in 2023 with a bond defeasance in 2025 and $3,172,025 in Principal and Interest will be paid in 2025. After this bond debt is paid off in 2025 the district will have approximately $6,262,000 in bond debt minus the the Series 2015 regular payments. The district has a Transparency page with real time bond debt data by clicking the title: BEEVILLE ISD DEBT TRANSPARENCY

The district currently has two bonds. In 2023, the Board of Trustees approved paying off the Series 2015A with a bond defeasance. This bond will be paid off in 2025. The Series 2015 bond is scheduled to be paid off in 2033. The Board of Trustees has the right to consider a bond defeasance to pay off this bond early. The new bond will have a term of 30 years, typical of school bond debt. The new bond will be callable after 10 years and can be refinanced if the interest rates are lower.

The district has a Transparency page with real time bond debt data by clicking the title: BEEVILLE ISD DEBT TRANSPARENCY

Property values are assessed by the Bee County Appraisal District. It is illegal for school districts to be involved in the valuation of properties. Therefore, the BCAD would have to answer this question. They can be contacted at 361-358-0193. A list of available property exemptions is provided by BCAD, which we provided in the above FAQs for reference.

The interest rate used in the bond projection is 4.61%.